Learn how our credit enhancement solutions can transform your business's financial future.

We provide credit enhancement solutions to strengthen your business's credit profile and improve access to financing. Our services help you secure the funding needed for growth and expansion, even in challenging credit conditions.

Our strategies are based on thorough market research and analysis.

We leverage our extensive network of financial partners.

We implement effective risk mitigation strategies.

We develop creative approaches to complex financial challenges.

A streamlined approach to improving your business's creditworthiness and financial opportunities.

The initial step in our credit enhancement journey begins with the loan application process.

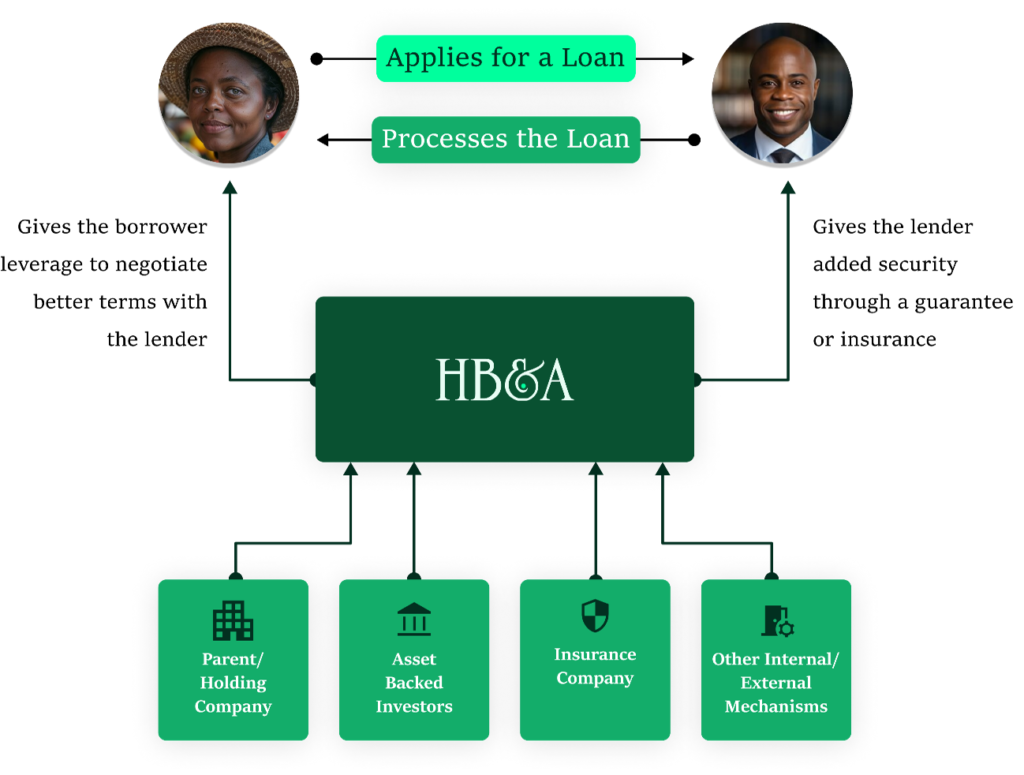

How we support both borrowers and lenders throughout the financing process.

HB&A connects with various entities to provide comprehensive credit enhancement solutions.

Discover the advantages of our credit enhancement solutions for your business.

Strengthen your business's creditworthiness and increase your chances of loan approval with better terms.

Secure financing with reduced interest rates, saving your business money over the loan term.

Benefit from longer repayment periods, improving your cash flow and financial flexibility.

Reduce the lender's risk, making them more willing to approve your loan application even in challenging credit conditions.

Our credit enhancement service is designed to improve our clients' credit risk profiles, enhancing their chances of securing debt capital while ensuring more favorable terms and interest rates.

Submit your loan application with all required documentation.

We evaluate your financial situation and identify enhancement opportunities.

We implement credit enhancement strategies tailored to your needs.

Secure loan approval with improved terms and conditions.

36 Modupe Johnson Crescent,

Surulere, Lagos, Nigeria

info@hbdaadvisorypartners.com

Phone:+234 817 157 0466

+234 805 076 2796

© 2025 All Rights Reserved.